May 7, 2020, Shanghai—A few days ago, JD Power (Jundi) officially released the 2020 China Auto Dealer Satisfaction Study (DAS). This research is an effective tool to measure the health of the relationship between manufacturers and distributors, and it is also a reference for manufacturers to evaluate distributors and adjust business policies. A total of 2,125 dealers were surveyed in this year’s research, and first-hand information about dealers’ living conditions and urgent needs was obtained.

The auto market has entered a period of deep adjustment

In 2019, a total of 22.196 million passenger vehicles were sold in China, a year-on-year decrease of 9%. The outbreak of the new crown pneumonia epidemic at the end of 2019 has further deteriorated the environment of the auto market, and the growth rate in 2020 may drop to -12%. The recovery is nowhere in sight, and car companies and dealers need to be prepared for a protracted battle.

The auto market has entered a period of deep adjustment

Dealer revenue and profits both continue to decline

In fiscal year 2019, total dealer revenue was 175 million yuan, down 5% from the previous fiscal year. The total profit was 2.28 million yuan, down 19% from the previous fiscal year. The income of major business units of distributors showed a downward trend.

Distributor’s annual income and profit composition

More pressure on new car sales and after-sales services

In fiscal year 2019, the new car sales and after-sales service business, which is the main source of income and profit for dealers, is under increasing pressure. In terms of new car sales, although improved inventory conditions and higher sales rebates make dealers more profitable in terms of new car sales. However, as the number of new car sales is still in a downward trend, there is not enough motivation to sustain profitability. In terms of after-sales, the number of monthly service desks and base customers of authorized dealers both decreased by 16% compared with the 2018 fiscal year, and the after-sales profitability of dealers is weak.

Increased pressure on dealers’ new car sales and after-sales services

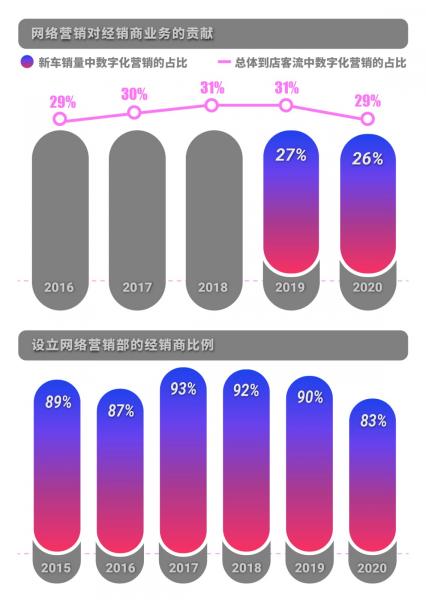

Dealers’ digital marketing business is stagnating

Over the years, the passenger flow and transaction volume brought by online marketing have not exceeded 30%. The bottleneck of customer acquisition and transaction in sales lies in the management, tracking and conversion of potential customers. Less than 50% of dealerships are equipped with lead management systems, and 28% of dealerships do not have other alternative systems for lead tracking. The stagnation of digital marketing business has in turn affected the enthusiasm of dealers in digital marketing. The proportion of the establishment of online marketing departments has decreased for three consecutive years, a decrease of 10 percentage points compared with 2017.

Dealers’ digital marketing business is stagnating

Under the epidemic situation, dealers have entered into a miserable mode

After the outbreak of the epidemic, dealers’ pre-sales and after-sales businesses are under enormous pressure. Throughout February, 16% of dealers had zero new car sales. The average single-store inventory pressure increased by 41%, and the number of service units entering the store per month was less than 100, a decrease of 85%.

New car sales and after-sales service business of dealers during the epidemic

Unprecedented manufacturer support and increased dealer satisfaction

In the face of the epidemic, manufacturers responded positively and gave dealers four support policies on average. The support focuses on reducing assessment indicators, helping to build an online sales platform, and extending the repayment period of inventory financing vehicles. Various timely supports basically met the most urgent needs of dealers, which in turn improved dealers’ satisfaction with manufacturers during the epidemic. The sincere cooperation between the two parties has become a ray of hope in the cold winter of the auto market.

Manufacturer support and dealer satisfaction during the epidemic

Manufacturers and dealers cooperate sincerely to help tide over difficulties